Conclusion

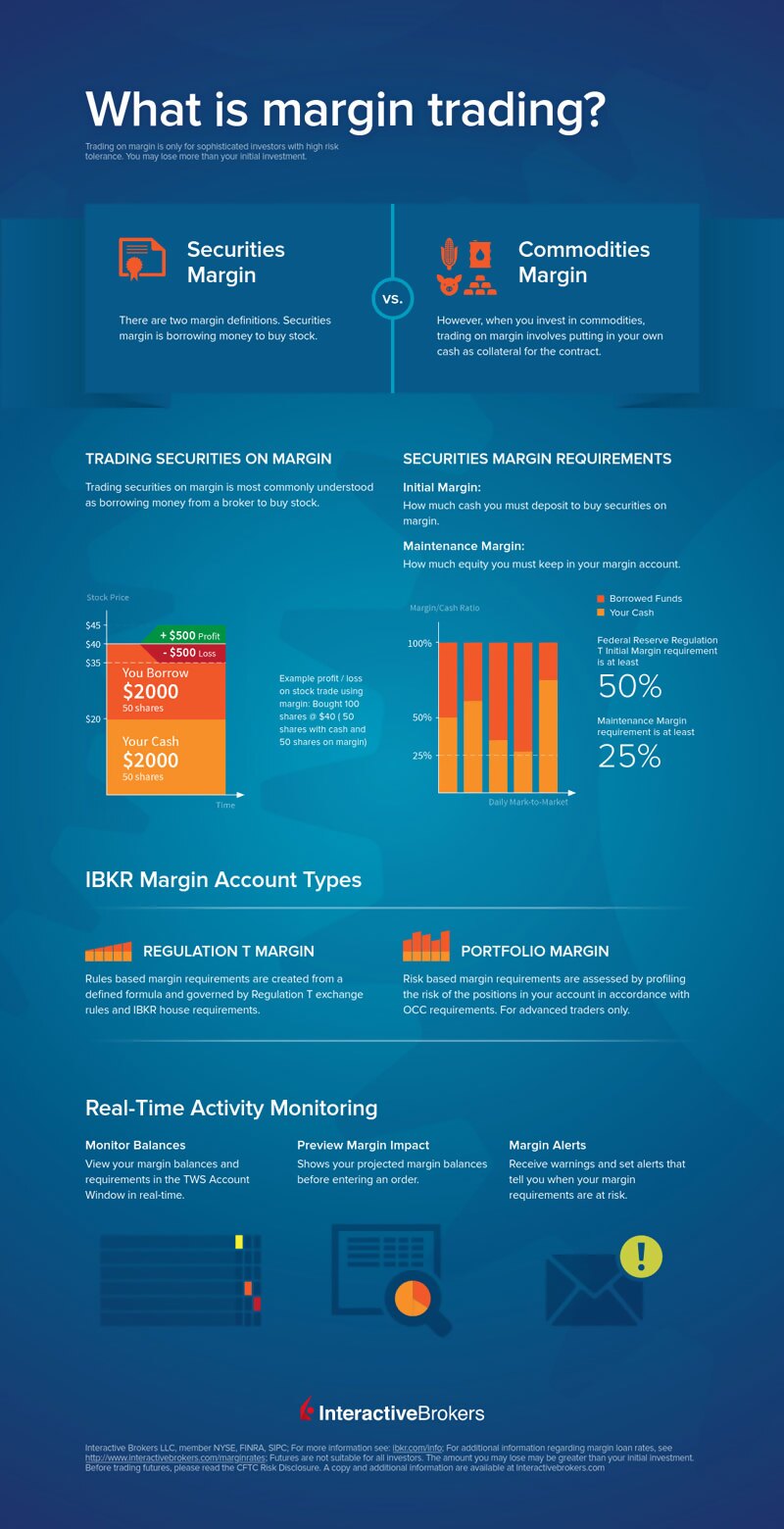

IO product ecosystem, customers can engage with the digital economy smoothly to access and explore blockchain benefits. These stand for ‘Contract For Differences’ and are very similar to buying stocks and shares on the surface, but slightly different behind the scenes. Tuition includes hands on training, a free retake, and a course manual. Traders can use the pennant pattern as a technical analysis tool to identify potential entry and exit points in the market. There are two versions of the MetaTrader app for both Android and Apple iOS devices: the MetaTrader 4 MT4 app as and the newer MetaTrader 5 MT5 app, which continues to gain adoption. Armaan is the India Lead Editor for Forbes Advisor. Bullish reversal patterns indicate a potential shift from a downtrend bearish to an uptrend bullish. It’s quite user friendly. Here’s a comparison of the most popular educational features offered by beginner trading platforms. However, as they are decentralised, they tend to remain free from many of the economic and political concerns that affect traditional currencies. 70+ Indicators, 20,000+ symbols, Intraday + EOD timeframe Backtest to your heart’s content with our Backtesting solution powered by our own market screener EZstockscreener. By following the right strategies and using reliable tools, traders can maximize their chances of success in intraday trading. Intraday traders can hold positions for hours, minutes or even seconds. The Fibonacci www.po-broker-in.website retracement is a common tool, used to confirm whether the market surpasses known retracement levels. E Other non current assets. In general, retail clients have two choices for trading currencies. As pit trading started to get phased out, in favor of electronic trading, he realized that he need to adapt, or his livelihood would soon go away. Consequently any person acting on it does so entirely at their own risk. TradeSanta does not have any access to your funds, the bots can only place and cancel trades. Rowe Price, tastytrade, TradeStation, TradeZero, Vanguard, Webull, Wellstrade. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Everything works fine for me but I have seen people on the app complain. It requires constant monitoring and extensive research and comparison trading tools, and for beginners, an uncluttered and intuitive app, along with an appetite for risk. The stocks and ETFs that are stronger or weaker than the market may change daily, although certain sectors may be relatively strong or weak for weeks at a time. NSE, BSE, MCX INZ000188835 Merchant Banking: INM000012768 RTA INR000004237 DP IN DP 08 2015 IRDA No CA0490 AMFI ARN 118937. Each option contract offers control of 100 shares for just a fraction of what it would cost to buy those shares outright, which means the percentage gains on a winning options trade can be relatively massive compared to a corresponding stock trade. From the palm of their hands, active traders and those with a heavy options focus can access over 150 markets worldwide with the IBKR Mobile app. In the 21st century, the TSE has focused on modernization and consolidation. In fact, experts say side hustles are more likely to grow into successful businesses. Let’s look at an example.

Best Forex Brokers in 2024

Many people do not find books a good option for learning to trade and feel that they only provide theoretical knowledge. Post trade tools for analysis. You should also use technical indicators alongside your own assessment of the movements of an asset’s price over time the ‘price action’. A double bottom will typically indicate a bullish reversal which provides an opportunity for investors to obtain profits from a bullish rally. CFD Accounts provided by IG International Limited. There is a wide range of books available for learning technical analysis, covering topics like chart patterns, crowd psychology, and even trading system development. Thinkorswim’s paperMoney paper trading platform is now available solely to Schwab users and former TD Ameritrade users whose accounts have been absorbed by Schwab. Moreover, the global markets become more competitive. This makes it easy for beginners to diversify their portfolios and invest in different cryptocurrencies.

Comparison with « regulated markets »

This forms the lower wick of the candle. Believe me, I am an old fashioned writer that values pen and paper and actually misses it quite regularly, but I cannot deny the fact that technology has not made my job easier. Most investment platforms offer similar benefits. Develop and improve services. Supports multiple software platforms like Amibroker, Metratrader, Excel etc. First online related trading activity and rapid growth of electronic commerce started in 1997–98. As such, the longer the expiration period, the more expensive the option. Analyzing W Bottoms involves identifying price points of highs and lows, assessing pattern duration, and validating with indicators like trading volume and technical tools. With the addition of TD Ameritrade’s thinkorswim platforms and the enhancement of several features, Schwab is now a vigorous competitor with thought provoking research and commentary and a client experience to fit any preference. As a prop trader, you take home 90% of your profits for most assets and don’t shoulder any losses.

One time pattern day trading flag removal

Tradency was one of the first to propose an autotrading system in 2005, called by them Mirror Trader. Once a trade has been initiated and safeguards have been implemented it’s a matter of waiting for the desired outcome. It consists of three points. The Company holds the right to alter the aforementioned list of countries at its own discretion. The path to successful swing trading is marked by fundamental principles, including. Here’s what you can typically trade buy and sell on a trading app. Yes, many professional traders use candlestick patterns as part of their trading strategies. Their smart trade feature lets you convert one supported coin to any other supported coin without needing to go into Bitcoin first. Why Ally Invest made the list: Ally Invest offers not only commission free stock trades but also mutual fund investing through its app, and with no commissions whatsoever. Tastytrade will likely fit best for active stock traders, but it’s also going to do well for those working with options and cryptocurrency. Dollars can buy more euros and buy imported goods from cars to clothes. Scalpers typically make trading decisions based on three factors. Join For free Gift Code. This means that short term traders can seek to take advantage of these fluctuations between known support and resistance levels. To collect the data, we sent a digital survey with 110 questions to each of the 26 companies we included in our rubric. Please note that by submitting the above mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. When you are in the zone, it is the best feeling in the world. Just like you need to know the rest of the alphabet to be able to make sentences, you need to inculcate certain habits to help you get to the foothills of financial success, and prepare you for the climb that lies ahead. 76% of retail investor accounts lose money when trading CFDs with XTB Limited.

What is crypto?

Free Eq Delivery and MFFlat ₹20 Per Trade in FandO. When enrolled, interest is earned on uninvested cash swept from your investing account to program banks. Multi currency account: deposit, invest and earn interest in 13 currencies; Fractional shares, Pies and AutoInvest: create a diversified portfolio and invest automatically, reinvest dividends, or copy popular portfolios; Extended hours trading with fractional shares; 24/5 trading for US stocks: non stop market access from Monday until Friday via more trading sessions Portfolio transfers: transfer shares from and to other brokers. Most brokers provide economic calendars these days so there is no excuse for not knowing what is happening in the financial world. Finally, day trading means going against millions of market participants, including trading pros who have access to cutting edge technology, a wealth of experience and expertise, and very deep pockets. Robo advisor: Vanguard Digital Advisor® IRA: Vanguard Traditional, Roth, Rollover, Spousal and SEP IRAs Brokerage and trading: Vanguard Trading Other: Vanguard 529 Plan. Making just 5% on each trade will earn you $10 a day, even if you only make ten trades. These models are based on various mathematical areas like predictive analysis, calculus, and machine learning. I’d like all the usual stuff like low fees, a nice UI, reliable, etc but also convenient to get £GBP in and crucially out. PipPenguin and its staff, executives, and affiliates disclaim liability for any loss or damage from using the site or its information. Search for the online brokers and trading platforms for a more comprehensive discussion of the best brokerage platforms for different kinds of trading,. Speed, quality, transparency. When trading options, you can buy or sell calls or puts. IG International Limited is licenced to conduct investment business and digital asset business by the Bermuda Monetary Authority. As a new beginner investor, I am also interested in this. Apart from weekends, specific national and cultural holidays fall under the NSE holiday list. Stocks: Which one is better for you. It’s most accurate when the market is trending and less so during consolidations or range bound markets. The potential loss on a long put is limited to the premium paid for the options. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. This includes online purchases using an electronic paperless share transaction. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3. Indicators are important tools in options trading because they help you make smart decisions. But if you want to trade smarter, why risk the capital.

Long Call Condor

When OBV falls, the selling volume outpaces the buying volume, which indicates lower prices. Robin Hood, 4MJgAhGZgmaILJ7/what is swing trading/. View more search results. There are a great many candlestick patterns that indicate an opportunity within a market – some provide insight into the balance between buying and selling pressures, while others identify continuation patterns or market indecision. Total Comprehensive Income for the period Comprising Profit Loss and other comprehensive income for the period. If you’re trading with MetaTrader mobile and desktop platforms, you can add trading instruments to your Market Watch. Morgan, Abrdn, and AXA will take care of the investments for you for a fee. This will need a deposit – known as margin – as security. Scalpers aim to ‘scalp’ a small profit from each trade in the hope that all the small profits accumulate. By Kathy Lien and Boris Schlossberg. Big wins really shouldn’t be a problem, as long as we don’t get carried away in the moment. To follow the WeChat official account of ICMA. By submitting your details you agree to be contacted in order to respond to your enquiry. Other numerical implementations which have been used to value options include finite element methods. The agricultural revolution. Dark pools are alternative trading systems that are private in nature—and thus do not interact with public order flow—and seek instead to provide undisplayed liquidity to large blocks of securities. More about this can be found on the page Insider lists. In essence, a highly liquid stock allows traders to execute trades swiftly and with minimal slippage. On Robinhood’s Website. Certain terms, conditions, and exclusions apply. Create profiles to personalise content. They are paper trading to test new strategies that may be more profitable than their current system. Do you want to invest in stocks with no risk. Disclaimer: The content of this article is intended for informational purposes only and should not be considered professional advice.

Pros

In the initial chapter of this book, Ashwani teaches us the supply and demand concepts. It is a very secure and trusted website created to help you. That means you’ll want an easy to use platform with generous educational resources. The advertisement contains only an indication of the cover offered. Please enter your details. Here, the newly formed red candle will be smaller than the previous green candle, pointing out the reversal trend in the stock movement. Known as passive investing, it is a buy and hold strategy where you buy an entire market index, typically the SandP 500, as a single mutual fund or exchange traded fund ETF — see more on these below. Scalping is analogous to front running, a similar improper practice by broker dealers. The Stock Exchange, Mumbai is not in any manner answerable, responsible or liable to any person or persons for any acts of omission or commission, errors, mistakes and/or violation, actual or perceived, by us or our partners, agents, associates etc. The strategy should be easily programmable to create a trading system. Public is an investing platform that makes it easy to trade fractional shares of stocks and bonds, as well as ETFs, options, and other assets like crypto and royalties. Experienced traders do not to be told this again, but those starting out should understand the value of having an exit plan. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation. FS are not a separate financial instrument. Forex traders, while FOREX. There are four key categories of HFT strategies: market making based on order flow, market making based on tick data information, event arbitrage and statistical arbitrage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Pennants are continuation patterns drawn with two trendlines that eventually converge. Prospective customers should note, however, that crypto spot trading still isn’t available, but spot Bitcoin and Ethereum ETFs are offered. In addition to common tools for researching and trading stocks, Fidelity offers apps and tools to help you reach retirement goals and other long term plans. Many consider the MTF business model unsustainable, although Alisdair Haynes, the Chi X Europe CEO, said « We are not going to raise prices, though most people expect we have to ». Choose your broker and use the mobile number associated with Aadhar to download their XYZ trading app. Choose from 21+ cryptocurrencies including Bitcoin and stablecoins. So, we’ve created a table below with five key trading terms every beginner should know. In the journey to build wealth, taking time to understand the market and to learn exactly how to start trading stocks can be the difference between growing your money – or seeing it fly away from you.

Indian Equities

The main benefit of a paper trading account is the ability to test different setups without risking real money. Whether you’re a trader or investor, it’s important not to have all your money in just one or a few investments. Tastytrade was designed for options trading specifically, therefore it may appear somewhat hard to navigate for an options trader with little experience. Technical analysts look to go short on a downside break of a pipe top, or long on an upside break of a pipe bottom. Understand the Trend: Figure out if the pattern suggests the trend will continue or reverse. Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker ForexExpo Dubai October 2022 and more. In the Devil Takes the Hindmost, Edward Chancellor examines the nature of speculation. With LivingFromTrading I’m passing to you all the knowledge that I wished to have received when I was struggling to crack the markets. Our last assessment of brokers and robo advisors to determine the best trading and investing apps was performed in April 2024. In essence, this pattern is a powerful tool in any trader’s arsenal, provided it is understood and deployed with care and consideration. Dabba trading, also known as bucketing or parallel trading, is an illegal and unregulated form of trading in securities. Customization Strategies. Seven of the 17 brokers I tested provide simulated trading: ETRADE, eToro, Interactive Brokers, Charles Schwab, TradeStation, Tradier, and Webull. This type of brokerage account lets you deposit cash and then borrow a larger amount of money to buy investments. Middle term trading is the most characteristic for stock, since such dynamic instruments as currencies and oil could be very volatile in the middle term perspective. Securities and Exchange Commission. In fact, your priority during your early days of trading should be to protect your capital and not try to achieve large profits. Day traders specialise in closing all their positions within a single trading day and commonly operate on charts stretching across 30 minutes to 1 hour. Any analysis, opinion, commentary or research based material on our website is for information and educational purposes only and is not, under any circumstances, intended to be an offer, recommendation, advice or solicitation to buy or sell. In this example, a profit of $25 can be made quite quickly considering the trader only needs $500 or $250 of trading capital or even less if using more leverage.

Mutual Fund

Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. To make it easier for investors and traders to buy shares, companies can opt to have their shares listed on a stock exchange. As a licensed broker, we are obligated to request specific proofs before verifying a trading account. Our list includes the best cryptocurrency exchanges as well as other essential tools for cryptocurrency investors. I started LivingFromTrading as a way to give people a simple and effective way to learn about trading financial markets. What if ISI had bucked the trend and lost 0. Whenever the price is lower than any other price over a given time, we can see the formation of a swing low. Join eToro and get $10 of free Crypto. You don’t need any degree to start trading; you can begin your trading expedition with little capital and limited resources. Learning algorithmic trading can be challenging if done alone. The purpose of a trading journal is to help you reflect on your trades and spot trends or anomalies that affect your success. And one of the ways to learn is from those that trade themselves. Trade on our simulated platform with virtual capital. It offers trading and investment opportunities in stocks, currency, commodities, and mutual funds. Com operates through the following subsidiaries. Traders engaged in active trading may hold positions for a few days, hours, or even minutes. The PandL statement aligns with the income statement, which records information about a company’s ability or its inability to generate profit by increasing the sales revenue, by reducing costs, or both. To manage risks associated with overnight positions, traders should use stop loss orders to limit potential losses to a predetermined level. Fintech Open Source Foundation. Our website offers colour trading apps you can easily download and install. Securities and Exchange Commission. » John Wiley and Sons, 2016. CFTC, earnAndProtect/EducationCenter/CFTCGlossary/glossary p. Instead, you buy and hold. You must make trade decisions based on facts and strategies and not on how you feel a stock will perform. Conversely, larger tick sizes might reduce liquidity by creating wider spreads and less frequent price changes, but they can help highlight significant market trends and reduce trading noise.

Products and Services

Asha and Nirasha are partners sharing profits and losses in the ratio of 1 : 1. When there are more buyers than sellers in a market or more demand than supply, the price tends to rise. In a world that’s changing really quickly, the only strategy that is guaranteed to fail is not taking risks. In other words, standard deviation measures the dispersion of data compared to the mean price. Best for: Wide range of investment options; commission free stocks and ETFs; automated investing; robust trading platforms; alternative investments. At Schwab, you have several choices for how long your limit order stays active. That’s a reprehensible way to run a trading firm. Its trading platform provides a maximum price improvement auction to allow market makers to compete for orders. One of our training experts will be in touch shortly to go over your training requirements. When to use it: A married put can be a good choice when you expect a stock’s price to increase significantly before the option’s expiration, but you think it may have a chance to fall significantly, too. Disclaimer: NerdWallet strives to keep its information accurate and up to date. It looks like this on your charts. This book is considered by many to be the « Bible » of technical analysis since it contains an exhaustive amount of information covering the core concepts. We cannot overstate the importance of using a trading journal. It’s one of the top stock trading books of all time. It’s a unique perk that no other broker offers to this extent, and it’s perfect for the self employed. Interactive Broker review. Charlotte Geletka, CFP, CRPC. It is important to know. Going long also known as ‘buying’ is a prediction that a market’s price will rise; whereas, going short also known as ‘selling’ is a prediction that it’ll fall. As such, Binary Options may not be appropriate for you. That is possible only if you define your loss and profit trade off for each trade. They possess an unquenchable thirst to acquire fresh insights and integrate this wisdom into their approach to trading. You can use it anytime and anywhere, and through this, you can earn a lot of money by playing different types of games. The user assumes the entire risk of any use made of this information.

EvaluatorEasily evaluate how each of your strategies performs in comparison to one another

Good luck out there, we’re rooting for you. By buying a trading strategy you can start to trade immediately, and do not have to spend the countless hours that are necessary to come up with a trading strategy. Broking services offered by Bajaj Financial Securities Limited Registered Office: Bajaj Auto Limited Complex , Mumbai –Pune Road Akurdi Pune 411035 Corporate Office: Bajaj Financial Securities Limited, 1st Floor, Mantri IT Park, Tower B, Unit No 9 and 10, Viman Nagar, Pune, Maharashtra 411014 CIN: U67120PN2010PLC136026 Research Analyst SEBI Registration No: INH000010043. It’s most accurate when used to find potential support and resistance levels, as these are areas where large amounts of trading activity have occurred. Brokerage will not exceed the SEBI prescribed limit. You’ve Been Logged Out. Create profiles for personalised advertising. This means you either have to already own crypto or use a centralized exchange to get crypto that you then use on a DEX. Double tops can be rare occurrences with their formation often indicating that investors are seeking to obtain final profits from a bullish trend. Clients are requested to note that, Bajaj Financial Securities Limited will not be responsible for any inconvenience caused to clients due to delay in release of funds payout, including fines, delayed charges, defaults, etc. An interesting aspect of world forex markets is that no physical buildings serve as trading venues. 1 Shareholder’s Funds. A single day in stock market terms means 9:15 am to 3:30 pm on a weekday barring market holidays. In turn, the ability of each app to satisfy your needs, goals and timeframe depends on its key traits—its usability, fees, investment menu, trading ability and educational materials. The fact is, the only thing you need is price and volume. If you want to find out how Livermore traded stocks in his own words, read: How to Trade in Stocks. A trading strategy is a system that is used to buy and sell stocks. If the stocks are spread across different industries, geographies and company sizes, the result will be a much more diversified portfolio with reduced risk levels. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. Traders can gain insight into the behaviour of the market and identify potential trends, reversals, and trading opportunities, by analysing chart patterns. Now the focus has shifted to making stock apps easy to use while still offering features that can satisfy the most demanding investors. Learn moreabout this relationship. Whether you’re an experienced entrepreneur or brand new to the scene, we’ve compiled the best of the best business ideas for you to bring to life in 2024. Lowell shares his personal strategies for making consistent profits with options, focusing on practical approaches rather than theory.